The Basics

The following are some comments and guidelines for starting to track and manage your finances from a real conservative person. They were written several years ago for a College and Career Sunday School class, and have been slightly updated and broadened to be of more use to those at all ages. They are still primarily oriented to people just trying to come to grips with financial matters.

This is only a first step. Some of the comments will perhaps be of use to all of you. Some may be of use in the future. Some may be completely worthless. I wish I could tell you in advance which comment falls into which category, but I cannot do that.

The first piece of advice is to start planning for your future now while your life is fairly simple. That is basically true for a person of any age. As years go by, life invariably becomes more complex. It is easy to expand a working system as this happens. It is harder to fit a complex life into a system later.

What Shape Are My Finances In Now?

It isn't possible to try to manage or invest your finances until you know where they currently stand. Perhaps you keep track of your finances by some method already. If your method is working for you, that's wonderful. You can skip over many of these basics.

If you aren't keeping track at all, or what you are doing doesn't seem to work, the following is a basic introduction for setting up a set of books for yourself. It isn't hard to do. It just takes a little time. It also doesn't take much time to keep your accounts up to date. It just takes some discipline.

Obviously, bookkeeping can be simpler on a computer and there are many good personal financial management programs in existence. If you use a computer program, follow its instructions and be sure to make frequent backups of your data. Several of the latest programs provide financial analysis and suggestions about how to improve your current situation. They also provide convenience functions like handling check writing and basic forms for tax purposes.

Keep in mind that their best suggestions are limited to the data you provide. This is also true when keeping books by hand. As the old saying goes - garbage in, garbage out.

If you don't have a computer or don't use your computer for accounting, take heart. Businesses existed profitably before the computer, and you can keep a perfectly respectable set of books by hand. It is a bit easier if you go down to the office supply store and buy some ledger and journal sheets on which to keep the books. That isn't required. A ruler and normal notebook paper will do in a pinch.

Chart of Accounts

The first procedure is to set up your chart of accounts. Computer and hand based corporate accounting systems include many accounts. They frequently have complete departments dedicated to major functions such as accounts payable, accounts receivable, inventory, payroll, and general ledger. This can get quite involved and isn't generally needed unless you are running a business out of your home. If you are, utilize an accounting firm and follow their advice.

The point of this exercise isn't to satisfy an accountant although I hope the system described would do so. The primary goal is to get a set of books that work for you and others who may deal with your accounting system. The same principles which govern corporate accounting are also used in home accounting. Home accounting has far fewer accounts and transactions to handle and no government regulations to cause problems.

It is easier to manage multiple accounts on a computer. Sometimes that leads to too many low level accounts which then have to be combined for meaningful reports. We currently have 242 separate accounts from `Books, Religious' to Bill's Non-Taxable Miscellaneous Income to Children's Expenses on our computer based accounting system.

When doing books by hand you can get by with many fewer accounts. It not only takes fewer pages, but it also makes it easier to total up categories by hand. The down side of fewer accounts is it is harder to break out how much you are spending in any one area. It is also harder to directly reconcile your records with W-2s, bank, brokerage, or mutual fund statements without waiting until all statements for a particular account have arrived and adding up the statements. If you don't balance one month, you then have more transactions to review to find the error. For this reason, I usually recommend having a separate account for each item you get a statement on each month. That way you can quickly compare and check for errors.

My wife thinks some of my accounts in the Tangible Asset area could be generalized. In fact, all charts of accounts get adjusted from time to time to keep everyone content or to handle new additions (like your first house or children). You will probably never have a completely final non-changing chart of accounts. If you do, you are probably grouping things into such a high level that you won't get much information from them.

The account numbers can be assigned as you please. Generally similar accounts get sequential numbers. Each major type of account usually starts with a different number so you can immediately see what basic type the account is just by looking at it.

My starting numbers don't completely correspond to accounting practice, but they keep the books simple to follow. In my numbering system, I have used the last digit of many accounts to indicate who it belongs to in the household; 1 is for me, 2 is for my wife, 3 and following are for children. This works for many Intangible Asset Accounts like checking / savings, petty cash, various income and various expense accounts. The first digits specify the account type, the last digit specifies `ownership'. Whatever method you select, strive for consistency in your numbering scheme when possible. It makes things much easier in the long run.

The chart of accounts is divided into the following general categories:

- Assets:Asset Account numbers normally start with a 1. Assets are things that you own. They are broken down into the following basic types, and some examples of each are given.

- Intangible Assets:These include soft assets such as checking accounts, savings accounts, petty cash, stocks, bonds, mutual funds, 401(k) and other retirement accounts, and accounts receivable (money you have spent on the job for which you will receive reimbursement or loans you have made to other people). In business, accounts receivable is normally a separate function which just reports a grand monthly total to the general ledger you are creating.

Checking accounts might be 101, 102, ..., 10n depending on how many checking accounts you have. Petty cash might be 111, 112, ..., 11n depending on the number of people in the family and how money is distributed. Stocks might be numbered 12001, 12002, ..., 120nn depending on how many stocks or mutual funds you have.

The same principles used to number Intangible Asset Accounts are used for numbering other accounts. Notice that account numbers can be of varying length. The only restriction is that they be unique for the entire year's business. Leave some numbers free after each basic account type to account for future additions. - Tangible Assets:These include hard assets such as houses, vehicles, RVs, furniture, books, CDs, records, tapes, audiovisual equipment (TVs, stereos, ...), equipment (kitchen stuff, appliances, tools, ...). The number of such accounts is limited only by your imagination, but you should not break things down so far that there are only a handful of items in each account. This is especially true when keeping books by hand.

- Intangible Assets:These include soft assets such as checking accounts, savings accounts, petty cash, stocks, bonds, mutual funds, 401(k) and other retirement accounts, and accounts receivable (money you have spent on the job for which you will receive reimbursement or loans you have made to other people). In business, accounts receivable is normally a separate function which just reports a grand monthly total to the general ledger you are creating.

- Liabilities:Liability Account numbers generally start with 2. This is money that you owe to someone else. Examples include credit cards, personal loans, auto loans, mortgages, and accounts payable. As with accounts receivable, in business, accounts payable is normally a separate function which just reports grand totals to the general ledger.

- Capital:There is a single offsetting Capital Account which balances out the above Asset and Liability Accounts. It generally starts with a 3.

- Income:There should be a separate Income Account for each type of income you get. This might include accounts like salary, wages and tips, royalties, rental property, interest, dividends, stock sales, pensions, IRA distributions, and miscellaneous. Always have a miscellaneous income account for transactions you didn't think of or those which happen infrequently. These generally start with a 4.

It can be a good idea to use an IRS 1040 form as a guide and make a separate account for each line item you normally have to fill in on the 1040. If more than one person in the family works, it can be a good idea to split out income and IRS relevant expenses for each to see if you are better off filing jointly or separately. If you have to fill out a Schedule B for interest or dividends, consider a separate account for each Schedule B entry. - Expense:There should be a separate Expense Account for each type of expense you incur. Include items like Federal W/H, F.I.C.A., donations, interest, groceries and restaurants, utilities, housing upkeep, insurance, automobile expenses, medical bills and prescriptions, clothing and cleaning, subscriptions, vacation, taxes (sales, property), entertainment expenses (movies, plays, concerts, video rentals), gifts, and miscellaneous. Again, include a miscellaneous expense account for infrequent or unexpected expenses.

If you itemize deductions, you should create separate Expense Accounts for each of the basic sections of Schedule A which apply to you to make tax preparation easier.

These accounts generally start with a 5. I run account numbers starting with 5 for 1040 government expenses (W/H, F.I.C.A., Sales tax). I use account numbers starting with 6 for Schedule A expenses. I use account numbers starting with 7 for other expenses.

Remember that whatever numbering system you decide to use should allow for easy addition of new accounts. It is hard to renumber accounts by hand at any time other than the start of a business year if keeping books by hand. It may also be difficult with automated systems depending on their features. Leave room wherever possible. Also, more frequently used accounts should be shorter to save writing or keystrokes when software is used. Other than the starting digit, there is nothing special about the account numbers.

Creating the Initial Entries

Since this is a basic introduction, I will only use the normal credit / debit terminology to identify which column of the standard ledger sheet should get the entry. You can just as easily use a single column and use +/- notations as indicated. It is usually easier to start at the first of a year, but it might also be good to do a trial run in the last few months of a year, get the bugs worked out, find out what does and doesn't work for you, and then start fresh with a working system at the start of the next fiscal year. This way, you would have good inventory information ready to go at the start of your tax year.

To set up your books, you make a separate page for each Asset Account and each Liability Account which applies to you, and the Capital Account. You also prepare pages for summaries of Expense and Income Accounts, Total Expenses, Total Income, and Profit / Loss. Add accounts and account numbers as necessary as your needs grow. When you are just starting out, you probably won't have many of these pages to worry about.

Tangible Asset Account Ledger Pages / Inventory

Take some scratch paper and make a heading on the top of each page for each Tangible Asset Account you have created. Take an inventory of your stuff. (This is good to do for insurance purposes as well - record serial numbers, models, et cetera.) Divide the items up among the various Asset Accounts which you have selected. If you have a video camera, make a video record of your inventory at the same time for insurance purposes. Getting a good inventory with reasonable estimates of value is usually the hardest part of setting up accounting.

Then take each inventory page and record the information on your real ledger pages. For each item in your inventory, record the date purchased in the date column (use the exact date if known, a close approximation, or if all else fails today's date if not known). Record what it is including model and serial number, and its value or approximate value in the debit (+) column on the lines of the appropriate ledger page. Go in date order with earlier acquired items listed first.

Then add the previous account balance (which starts out at 0 for each Asset Account) to the value of the item being listed and record this as the new balance on the same line. Typically, these will be written in black ink reflecting positive value. Generally, assets are recorded at purchase price, regardless of current value. When the asset is disposed of, any gain or loss from the purchase price is reflected as miscellaneous income or expense for the year in which the sale occurs. Business inventories are more complicated, with IRS rules on valuations which you don't have to worry about at home.

Intangible Asset Account Ledger Pages

Your current checking and savings account balances become the initial balances for each of their asset pages. Your cash on hand becomes the initial balance for your petty cash asset page. It is frequently easier to give each person their own petty cash account since each person handles petty cash differently. These are all debit (+) values unless you are currently overdrawn on a checking account.

Liability Account Ledger Pages

Make a similar set of pages for each liability you have. Include each credit card, loan, mortgage, or account payable. The current balance you owe for each of these items becomes your initial balance for these ledger pages, but it is a negative balance instead of positive, so is recorded in the credit (-) column. Typically, these values are entered in red ink instead of using a minus sign. Hence, the expression hemorrhaging red ink for companies in trouble. Accountants are different - go figure.

Capital Account Ledger Page

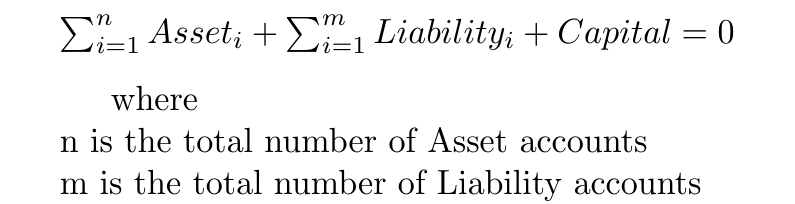

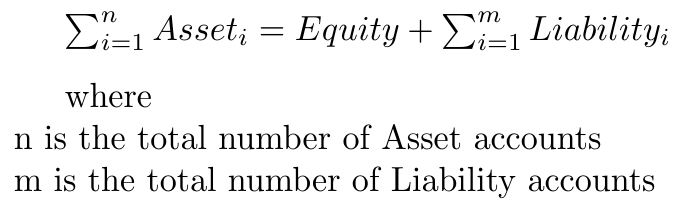

Your Capital Account initial balance will be the sum of all the Asset and Liability Account balances, but have the opposite sign of the result. Thus,

with the offsetting Capital Account entry computed from Equation 1, your books are initially balanced.

Say you have $3,000 in assets (Asset = +) and owe $1,500 on a car loan (Liability = -). The Capital Account initial balance would then be $1,500 and would be a negative value. (+3,000 + -1,500 + -1,500 = 0.) Negative Capital values, indicating more assets than liabilities, are good things! That was easy enough, right?

Profit / Loss Ledger Page

Next set up a Profit / Loss page. It starts out at 0 each year. It just has a heading at this point, but will get a profit or loss value added to it each time you close out your books (typically once per month).

Income / Expense Account Ledger Pages

Next set up the Income and Expense Accounts. They are similar to the asset and liability pages with a separate page for each Income and Expense Account you have created. Each account likewise starts out at 0 each year. The procedure I will describe will also require a Total Income ledger page and Total Expense ledger page which start at 0 each year. Monthly totals are posted there and to the Profit / Loss page.

| 1 | 2 | 3 | 4 | 5 | 6 | ||||

| Date | Description | Cash | Checking | AmExp | MCard | Visa | Discover | ||

| 1 | mo/da | transaction | 1 | ||||||

| 2 | 2 | ||||||||

| 3 | 3 | ||||||||

| 4 | 4 | ||||||||

| 5 | 5 | ||||||||

| ... | |||||||||

| 30 | 30 |

| 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | ||

| Auto | Donations | Entertain | Groceries | Ins. | Interest | Misc. | Util. | ACC# | Amount | ||

| 1 | 1 | ||||||||||

| 2 | 2 | ||||||||||

| 3 | 3 | ||||||||||

| 4 | 4 | ||||||||||

| 5 | 5 | ||||||||||

| ... | |||||||||||

| 30 | 30 |

Journal Pages

Finally, using the journal style page instead of the ledger type page, create the journal in which you will post the year's business. Start on the back of the first page with headings for date and description. Let each main column reflect a heavily used Intangible Asset or Liability Account which you buy things with and/or Expense Account entry. Leave the last two columns for miscellaneous as in Table 1.

Note that I have included only a single cash / checking account, and various credit cards on the left side of the page. With a family it might be better to include multiple checking accounts / petty cash accounts and leave the credit cards to the miscellaneous columns at the right. If you're heavily addicted to buying things only with credit cards, the reverse might be true with credit card columns predominating and cash or checking accounts relegated to the miscellaneous columns.

With limited columns, it can be tricky to decide what columns to dedicate to what account. After a bit of time, you can see which accounts you use most and dump all other transactions into the final two miscellaneous columns. Since one line for X pages is used per transaction, it is best to try to keep the number of pages to a single back and front pair, but multiple pages can be used if needed. It is also possible to record more than one transaction per line if they occurred on the same day and used all different accounts, but this is frowned on by purists.

Everything you buy or sell and every bit of income you receive creates a minimum of two general ledger entries. This is called double entry bookkeeping, and is the classical form of bookkeeping. It is a little more work, but easier to track where money is coming from and going to. All transactions go into the journal. If there is a column for the account, use the column to enter the amount of the transaction (with a + for a debit entry and a - for a credit entry, or using the right color ink for the purists). If a column exists, you don't have to write the account number with the transaction since the column heading identifies the account where the money was spent or received.

You could waste a little more space and use two columns for each account with the left side reserved for debit (+) entries and the right side for credit (-) entries for those accounts (like Asset and Liability Accounts) which typically have a lot of entries of both types. (Again, for the purist you still have to use the right color ink for each column.) I feel that in the interest of space it is better to use a single column with +/- notations or different colored inks to distinguish credit and debit entries.

If there isn't a column for the accounts involved, note the proper account number and amount in the rightmost two columns of the ledger (15 and 16). Keep track of the sign of the amount or use the right color ink for the amount. When the page is full, start over on the next pair of pages with the same headings.

Sample Transactions

Now for some hypothetical transactions.

Paychecks

Say you get paid $750. Your F.I.C.A. payment was $60, the federal withholding was $110, there was some insurance for $25, leaving a net of $555 dollars. Of that, say you wanted $50 in cash and the rest was to be deposited in your checking account. The following transactions would result and would all be on the same journal line if you write small. Otherwise, they may need two or more lines since there aren't separate columns for some of the entries.

The petty cash account column gets a debit (+) entry of $50.

The checking account column gets a debit (+) entry of $505.

The insurance account gets a debit (+) entry of $25.

In my example, the rest don't have their own columns, so the account number and amount go in the rightmost two columns. Your F.I.C.A. account gets a debit (+) entry of $60. The W/H account gets a debit (+) entry of $110.

The wages income account gets a credit (-) entry of $750, which balances the whole set of books out again. Every transaction which is posted must balance the debit and credit entries out to 0, although it may require several entries to do this (six in this case).

Tithes

A further transaction on the income is posted shortly after this. The donation account gets a debit (+) entry of $75 reflecting the check you are going to write as a dutiful Christian, and the checking account entry gets a credit (-) entry of $75.

Gifts Received

A cash check on your birthday from a relative would be entered into checking as a debit (+) entry and into non-taxable miscellaneous income as a credit (-) entry.

Gifts of physical things which are durable would be entered into the normal Tangible Asset Account as a debit (+) entry and into the Capital Account as a credit (-) entry.

Standard Expenses

Say you go out to dinner and spend $10 out of petty cash.

The petty cash account gets a credit (-) entry of $10, and the groceries / restaurant account gets a debit (+) entry of $10.

Say you buy gas for your gas guzzling truck for $20 and pay for it with a credit card.

The associated credit card account gets a credit (-) entry of $20, and the automobile account gets a debit (+) entry of $20.

Credit Card Payments

Say that the credit card bill comes in showing a new balance for $50.

The transaction which should occur is a credit (-) entry into checking for $50 and a debit (+) entry for the same amount into the credit card account. This removes the liability from the accounts.

If you can't pay the whole debt at once, then note the amount of finance charge being imposed along with any other fees by looking at the statement and put that portion of the amount you are paying into the interest expense account as a debit (+) entry. The remainder of the payment you are making goes into the credit card account as a debit (+) entry and reduces the overall balance on the card.

Buying a New Tangible Asset

Say that you buy a new stereo for $600 with a check.

There would be a $600 credit (-) entry in the checking account.

There would be a $571.43 debit (+) entry in the Stereo/TV tangible asset account. Again, use the last two columns to record this entry.

There would be a $28.57 debit (+) entry into the sales tax (or miscellaneous expense account if not broken out separately). Miscellaneous charges associated with purchasing a hard asset can't go in the asset column. They don't form any part of the basis cost of the item. Since sales tax can't be deducted anymore on income taxes, it isn't necessary to break it out of any normal expense item.

Note that as far as the books are concerned the sales tax is the only expense in buying a tangible asset. Accounting basically views the transaction as a transfer from soft (intangible) to hard (tangible) assets. If an asset is eventually sold for less than its purchase price, you have the reverse set of entries as follows.

Say that the system was sold several years later for $400 and the proceeds deposited in checking.

The checking account receives a debit (+) entry for $400.

The Stereo/TV account receives a credit (-) entry for $571.43.

The miscellaneous expense or depreciation expense account receives a debit (+) entry for $171.43 indicating your loss on the transaction.

Buying a Car with a Loan

As final examples, let's look at loans. Say you purchase a car for $10,000, and pay $2,000 as a down payment from checking. Assume you get a 5 year amortized loan at 10% annual interest for $8,000. Your monthly payment would be $169.98.

You add the price of the car $10,000 to your vehicle asset account as a debit (+) entry.

The checking account gets a $2,000 credit (-) entry.

You create a new Liability Account for the new loan with an initial credit (-) entry of $8,000.

The example numbers are for the first month. It also assumes that you pay exactly on the due date. You would take the current value of the Liability Account (the loan balance) times the periodic interest rate (10/100/12) and subtract the result from the total payment. This interest payment ($66.67) would be recorded as a debit (+) entry in the interest expense account. The remainder of the payment ($103.31) is what you paid on the principal of the loan. It would be a debit (+) entry in the loan account. The payment itself ($169.98) would be a credit (-) entry in checking. Actually, there are generally some additional interest charges the first month from the time of the loan's closing to the first payment, but they vary with each loan and you would have to get those numbers from the bank.

Buying a House with a Loan

Assume you buy a house for $88,500 with an interest rate of 8.25% fixed over 30 years. You pay $13,500 down, and get a mortgage for $75,000 + $2,850 in other loan charges for a total loan of $77,850. For the loan itself, this yields a monthly payment of $584.86 for principal and interest. Escrow of insurance and taxes adds another $30.33 for insurance and $50.64 for taxes. $665.83 is your total PITI payment per month. These are all very old numbers by the way!

Your housing asset account gets a $88,500 debit (+) entry. Your checking account gets a $13,500 credit (-) entry. Your mortgage liability account gets a $77,850 credit (-) entry.

Again, assuming you pay via electronic transfers so the payment occurs on the exact day it is due, the following transactions occur for the first month. The checking account gets a $665.83 credit (-) entry. The interest paid account gets a $535.22 debit (+) entry. The mortgage liability account gets a $49.64 debit (+) entry. The insurance account gets a $30.33 debit (+) entry. The property tax account gets a $50.64 debit (+) entry. You also set up an escrow account for these last two items and record the actual bill payments when they occur as transfers from escrow.

Run out an amortization schedule so you will know how much of your payment goes to principal and interest each month or take the balance times the interest rate (8.25/100/12). With all bank loans, if you don't do electronic transfers, there is a very good chance that the payment won't arrive and be posted exactly on the day the loan payment is due so you will need to make an adjusting entry when the bank sends you your statement at the end of each year reflecting the total interest actually paid. If paid electronically, it should be identical subject to very rare one penny rounding differences.

If you itemize deductions on Schedule A, keep this interest paid separate from that paid on credit cards which isn't deductible. Note that property taxes are also currently deductible as are portions of vehicle taxes based on valuation. Depending on use, certain second mortgage interest may also be deductible. Consult your tax adviser for specific situations. Donations and medical expenses, along with certain expenses for generating income are deductible within certain limits. Credit card interest isn't deductible.

Closing the Books for the Month

Closing the Journal

On a monthly basis (usually on the last day of the month), the books are closed. Draw a double horizontal line across the journal page and add up the totals for column 1 through 14, writing these totals under the line. Then draw a line under that.

Posting Journal Totals to General Ledger

Post these net monthly results to each Asset, Liability, Income, or Expense ledger page as appropriate and adjust their balances. For income and expense pages, the credit or debit entry reflects the account activity for the month being closed, and the balance after your entry then reflects the year to date figures.

The miscellaneous entries in the right two columns have to be posted separately to whatever account they were associated with. If the same account is referenced more than once, add up all of its transactions just as you do with the column journal entries and just post the result. In the cases of major purchases to Tangible Asset Accounts, summarize the purchases on the asset pages as well so you have an easy place to find information about inventory items if needed.

The checking account balance should match what your checkbook has. Your cash account balance should match the sum of your petty cash. (If it doesn't, make an adjusting entry where it was most likely spent - food, et cetera so everything balances - check this before you actually close or make the adjustment the first entry in the next month's business.)

If you are using official bookkeeping pages, the number of the line the month is closed out on in the journal is recorded in the folio column on the ledger page.

Posting Total Income / Total Expense Ledger Pages

Add up all of your individual Expense Account entries for the month. Post this as a debit (+) entry to the Total Expense ledger page. Add up all of your individual Income Account entries for the month. Post this as a credit (-) entry to the Total Income ledger page. Adjust these two page balances for the new entries so you now have year to date amounts for income and expenses.

Posting Profit / Loss Ledger Page

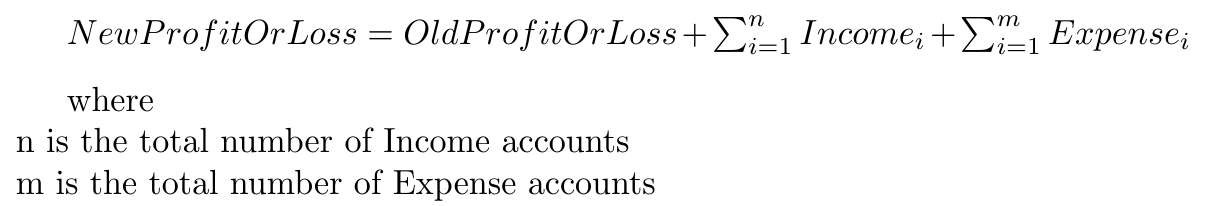

Post the Total Expense for the month in the debit (+) column of the Profit / Loss page. Post the Total Income for the month in the credit (-) column of the Profit / Loss page. Adjust its balance to reflect these two entries

as seen in Equation 2. The resulting balance is your year to date Profit or Loss. (Note that since Income is a credit (-) entry, the result will hopefully be a negative value reflecting more income than expenses.)

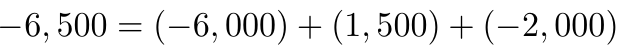

For example, if you had a profit to date of $6,000, you had expenses for this month of $1,500, and income of $2,000, then the new profit would be $-6,500.

The details are found in Equation 3.

Closing Out Books for the Year

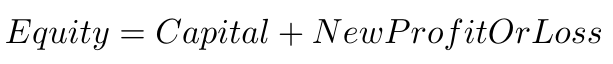

To close out the books for the year, the following transactions occur. If you have a profit, a matching debit (+) entry is added to the Profit / Loss ledger page and a credit (-) entry is added to the Capital Account. If you have a loss, a matching credit (-) entry is added to the Profit / Loss ledger page and a debit (+) entry is added to the Capital Account. In either case, the Profit / Loss page is now zeroed, and the Capital Account reflects all the year's business.

Then create new pages for the next year's Profit / Loss, Income, and Expense pages, or draw a double line under each and start the new year's business starting with 0 balances for all of these accounts. Archive the Journal pages and start a fresh set.

Statistics: Measures of Financial Health

Once you have these numbers, you can see where you are. There are several useful ratios which you can look at. The first three give long term financial health information. The last three give short term financial health information. Unless you are currently in financial difficulty, don't be alarmed at the first numbers you get. Simply try to work to improve them over time.

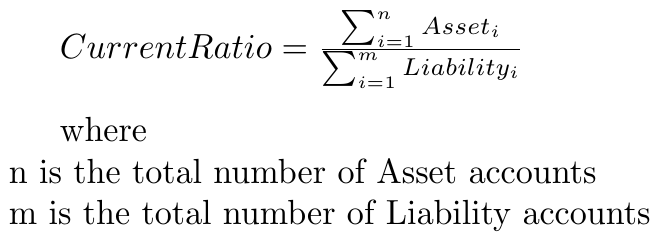

Current Ratio

This ratio is a measure of financial health and should be considered when taking on new debt. Companies regard 1 to 2 or higher as strong ratios. Lower numbers are worse and higher numbers are better. If you have no debt, this is an infinite number. If you have no assets, this is 0.

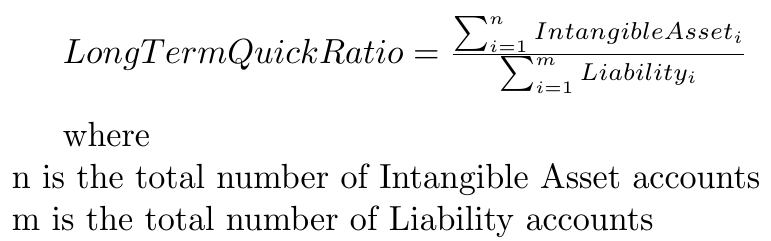

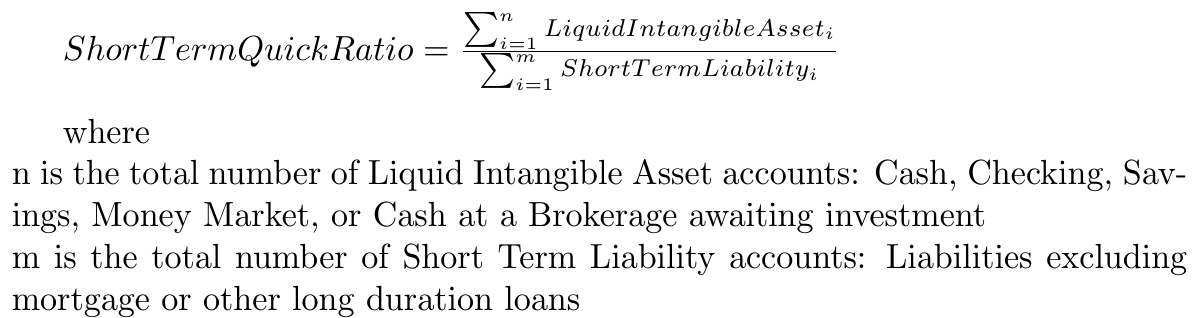

Quick Ratio

These ratios measure how much reserve you have if you had to pay off debt without selling hard assets. The long term quick ratio reflects all monetary assets and all debts. The short term quick ratio excludes monetary assets which can't be quickly converted to cash without penalties such as bonds, stocks, IRAs, 401(k) plans, pensions, et cetera. Likewise, debt with terms of over 5 years such as mortgages wouldn't be added on the liability side.

1 to 1 would be considered very strong if all liabilities are included. You should at least have a greater than 1 to 1 ratio if you only include short term (credit card type) debt in the liability side of the ratio. As with the previous ratio, if you have no debt these are infinite numbers.

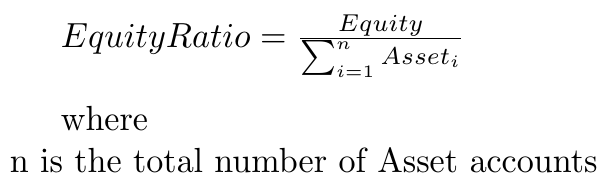

Equity Ratio

This ratio reflects how much of your assets you actually own. The biggest value here is 1 if you have no debt. Generally, the closer you can approach 1 the better.

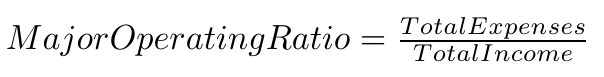

Major Operating Ratio

This ratio reflects how much of your income you are spending and how much you are saving. A number greater than 1 over a wide enough time frame is a definite problem (spending more than you earn). But any number over .85 would be a red flag indicating you need to be diligent in reducing general purpose expenses wherever possible.

Note that any tangible asset purchase goes directly to an Asset Account rather than an Expense Account so doesn't get reflected in this ratio. Just because you have a good ratio here doesn't mean you are out of the woods if you are buying a large amount of hard assets.

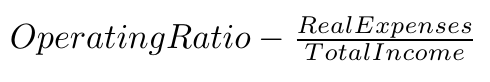

Operating Ratio

This ratio is similar to the above figure, but has expenses which are not actual cash transfers removed. These might include expenses like depreciation where assets are reduced in value without any real money transfers taking place. In addition, certain nonrecurring expenses might be removed.

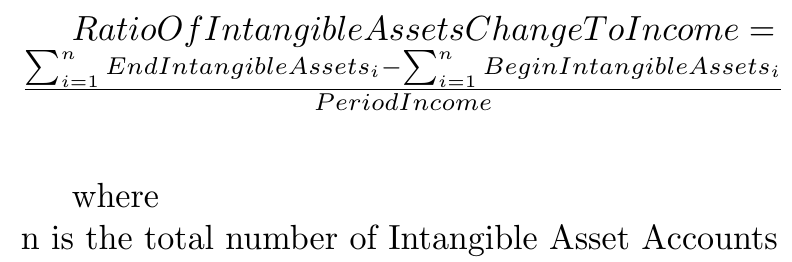

Ratios of Change in Assets / Income

Ratio of Change in Intangible Assets / Income

This ratio is the amount of your income you are actually saving in a liquid form. It isn't being spent on expenses or for tangible assets. You should shoot for 20% as a minimum. For a historical perspective, total your current intangible assets and divide this by all income you have received in your lifetime. You can check old 1040s to get some idea of what this total is, although they probably won't include all income. It is good to keep track of both figures to be sure you are historically saving enough for retirement.

Substantial savings is hard to do in the early years when you are working part time jobs. It gets easier after you start working full time. The Japanese save about 30% of their income. Most Americans save around 5% or less, although this has been climbing slightly in recent years as more cash is poured into mutual funds and 401(k) plans. If you are paying down debt in advance of the required loan schedule, you can also include the amount of any prepayments you made during the period against the principal of loans when calculating the percent. Simply add in the difference between the total liabilities at the start and end of the period.

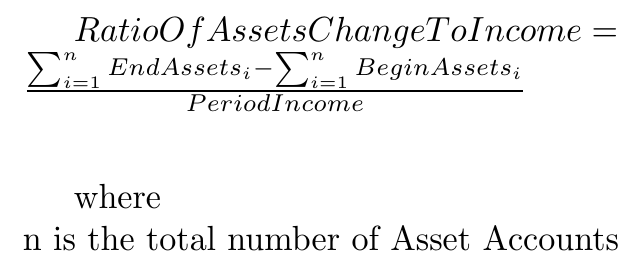

Ratio of Change in Assets / Income

This ratio is similar but reflects the total amount of your income you have put into either intangible or tangible assets which could be sold in a pinch. This ratio can also be modified to reflect any change in liabilities over the period. This can help to eliminate the effects of buying large items with loans since the liability total would increase for the period at the same time the asset total increases. This total ratio should be at least twice the ratio of intangible assets alone.

You should also compare this on a historical basis with historical income to see how you are doing in any particular month or year.

Budgeting

Having some historical information on how much you are spending for each category is the first place to start in the budgeting process and that is the purpose of the accounting procedures above. If expenses are too high, you can set target reductions for the categories which you have a choice about, and try to ensure that the other categories don't grow any more. Doing the books by hand may entail adding up the appropriately targeted columns more than once per month to see how close you are running to your budgeted amount. Every budget takes some fine tuning, so don't worry if you don't get things perfect the first time. Remember that it isn't a moon shot. Keep adjusting until the expenses are within your limits.

In order to obtain your goals, you might have to budget your expenses. There are a wide class of expenses which you can't do anything about. The government giveth and the government taketh away - but mostly it taketh and it taketh first. The tithe is another one of the expenses you can't do anything about. It is God's and if you don't give it voluntarily, Satan will take it some other way. That doesn't change what is due to God's service, and withholding tithes from Him incurs a 20% penalty. I don't want to pay His late charges.

If you are in financial difficulty, here are some ways to save a buck here and there. They may be of some use even if your finances are in good shape.

- Physically take care of yourself - eat properly, drink properly, exercise, don't take unnecessary risks (particularly while driving). This will reduce big medical bills over time for doctors, dentists, et cetera.

- You can teach your kids to take care of themselves for the same reasons. Get them vaccinated against every disease possible. Give them love, affection, and attention. Although not usually considered financial advice, this will help in the long run. Teach your kids sound financial principles. Teenagers spend hundreds of billions of dollars every year. Remember that examples of proper living do more than words in training your children.

- If you have bad habits like smoking or drinking, give them up. My dad smoked from the time he was 16 until he was 77. He died at 79. At a carton a week, the cost of that habit added up drastically. At the end, he couldn't walk half a block without being out of breath. He died of a heart attack. His heart was enlarged from overwork trying to get oxygen to his body due to problems with emphysema.

Add to the cost of cigarettes the additional cost of medicine and hospital bills from smoking related problems and you have a huge potential savings by getting rid of this one habit. If your habit is something else, seriously consider removing it and its expense. - To help increase savings, bank any unexpected or windfall income immediately, rather than spend it. Windfall income may include IRS refunds (although it is better to adjust the withholding so the government doesn't get as much) and bonuses. In addition, although I don't necessarily recommend mutual funds, automatic deductions from checking accounts to mutual funds can help increase saving rates. Use electronic transfers when possible. The less time money actually spends in your hands in cash or check form, the less likely you will be to spend it.

- You might be able to reduce utility expenses a little bit by wearing sweaters and turning down the thermostat, by not making as many long distance telephone calls, by dropping cable TV, turning lights off if you leave the room, not bothering with an air conditioner in the summer in Wyoming, et cetera. Keep in mind the total cost to operate any new appliances you purchase. Also remember that utility savings take a tremendous amount of time to pay for the cost of a replaced appliance. Make sure things are worn out before you replace them and then replace them with the best total value item you can find.

- You can buy more generic or bulk foods to drop the grocery bill. You can eat out as a family less often. You can pack lunches instead of going out to lunch at work. You can quit stopping at the local convenience store for anything. You can buy your soft drinks at a grocery store and take them with you rather than pay an exorbitant price at a machine just to have the pop cold. Avoid snack machines. You can cook instead of buying prepared foods. You can stop buying prepackaged snacks like pudding in a cup and buy the raw materials. Drink you water with a glass from a tap instead of prepackaged in bottles with a pretty label on the outside.

- You can buy fewer new clothes to help on the clothing expenses. Don't buy any designer clothes. Give old clothes which have been outgrown but are still in good condition to the Salvation Army rather than throwing them away.

- You can examine miscellaneous and entertainment expenses and pare them as needed. If you go to movies, eat before going and just watch the movie. At current retail prices, wait a couple of months and buy the movie from a store instead of going to the theater or renting at all. Then you can watch it when you want for about the cost of one theater ticket when first released.

- I don't feel Christians should have any of the following expenses, but try to avoid over limit charges, returned check charges, and other penalties whenever possible.

- Don't run so near the edge in paying bills that you get a late charge. Whatever additional interest you earn can be more than offset by a single late fee. When paying bills, pay them as you would wish the money to be paid if you were presenting the bill. Just because an invoice says net-30 doesn't mean you shouldn't pay it immediately.

- Although there is some safety in having a checking account or assets in at least two separate unrelated locations to guard against failures, there are other advantages in not spreading yourself too thin. By lumping accounts together, you can perhaps reduce or eliminate bank fees. Should you find yourself in good financial health, remember the FDIC only insures a specific limit per individual. If a bank fails and your accounts have more than the protected limit in assets, you are out of luck. One way to increase the effective limit is to have one account in your wife's name, one in your name and one jointly held and use multiple non-related banks.

- Keep the same car for a long time to increase your savings rate. Unless the type of vehicle you need changes for some reason (more kids than seats for example), you can do a great many repairs on an older car compared with buying a new one (even if used).

- Unless you really plan to drive around the country for many years, avoid buying an RV. Even very expensive motels are far cheaper and give everyone in the family a vacation. Does anybody in Wyoming really need a boat?

- Reduce the number of tapes and CDs you buy by listening to the radio instead. Reduce the number of books you buy by utilizing the library.

- When you go on vacation, stay in less expensive motels or with friends and relatives. Open up your home to friends and relatives who come here and let them know they are welcome. Dine at normal restaurants or buy groceries and make a few meals yourself.

- Cut unneeded subscriptions and share magazines and papers. Give the environment a break at the same time.

- Pets can provide a lot of companionship, but they are also expensive. The bigger the pet, the bigger the food and other bills.

- Make or grow what you can.

- Keep the number of gifts given to a minimum. Some families go overboard for birthday and Christmas presents to the point that the kids don't even learn to appreciate what they do receive. Give cash. Nobody will ever have to take that back to the store to exchange it; it is never the wrong color; it is never the wrong size.

- Although it can sometimes cause problems between friends, borrow what you can and loan to others in need to prevent having to spend money for something you may only use once or twice a year.

- Don't concern yourself with what the people next door are doing. Just because they get themselves into trouble buying a boat and motor home, you don't need to follow suit.

- Shop with a list. Avoid going to stores or doing any shopping on the spur of the minute. Make a summary of stores you need to go to and go directly there. If you see something you want but don't immediately need, wait for it to go on sale. Unless you are looking to purchase a particular item and need it train your eyes to ignore ads in newspapers and on TV. Use the mute when a commercial comes on or turn down the volume. Use a VCR and fast forward over the commercials completely.

- Shop second hand stores and garage sales - but again - only with specific objectives.

- Take care of what you have so you don't have to replace it. Do the normal vehicle maintenance. Don't wait for something to break.

- Don't store stuff you don't need. Sell it or give it to someone in need. Recycle.

- Throw out sales literature that comes to your door. If you don't see it you won't want it. Get off mailing lists when possible; it is good for the environment.

Having said all that, remember that if you cut so much that you don't feel life is worth living, you are damaging your psychological health. Any budget should be able to be structured so that you can treat yourself and your loved ones to occasional good things. You can even budget in a surprise of $X per month to be spent however the family decides. Just keep from going overboard. Put God first. If you ask Him when you are in doubt and listen to what He says, many budget problems will be solved.

Credit Cards

If you are carrying a balance on a card due to making less than full payments each month, a portion of the amount you are paying will go to reducing the balance, and a portion to interest. Try to pay off your balances as soon as possible - preferably as each statement arrives. This saves interest and also restarts most card's grace periods so new purchases don't immediately start accumulating interest.

In your mind, make purchases with credit cards just like paying with cash or checks. If there is some doubt when you are about to buy something as to whether you will have the money to pay for it when the credit card statement arrives, put off the purchase. It will rarely kill you or anyone else to do this.

Always pay more than the minimum balance. Here are a couple of scenarios for a hypothetical purchase.

- Assumptions - You have $5,000 in the bank. You have a credit card with a $2,000 limit which can handle a $1,000 purchase you want to make. No grace period is in effect. Your credit card interest rate is 19.89% and your checking account interest rate is 2.8% (probably optimistic these days).

The minimum credit card payment is 2% of the final statement balance including that cycle's interest or $15.00, whichever is greater or the balance + accrued interest if less than $15.00.

On 1/1/1999, you purchase $1,000 worth of stuff using the card. This gives you starting assets of $1,000 in stuff and $5,000 in the bank. You make no other charges to the credit card or changes to the bank balance, You pay the minimum requested amount on each credit card statement when due from the bank account. On 8/1/2011, almost 13 years later, the credit card bill is paid off. You have paid $1,417.07 in interest to the credit card company and received $1,591.73 interest from the bank.

Now assume that on 1/1/1999 you pay for the $1,000 worth of stuff from checking. This gives you starting assets of $1,000 in stuff and $4,000 in the bank. Under the same constraints, when the credit card bill above would have been paid off you would have received $1,673.59 in interest from the bank.

Comparing final assets values (stuff + final bank balance), the total cost of using plastic and making only the minimum payment is $1,498.93. - If the interest rate on the card is 9.99% instead, then the total cost is only $302.42 under all the same assumptions, and the debt is extinguished by 4/1/2006.

If you must carry a balance, look for a credit card with as low an interest rate as possible. The nearer the credit card interest rate is to the bank interest rate, the more sense credit cards make. The danger is always that something will happen so that you can't make full payments on the credit card debt and you get into trouble.

If you are routinely getting behind, cut up the cards and stop using them. Another approach is to freeze them in a block of ice in your freezer so you still have them but they are very hard to physically access. You could also lock them up in your safe deposit box. Don't waste money on credit insurance which will only pay off your minimum payments under narrow circumstances. Be sure you have the money to do that yourself if necessary.

Other than true emergency situations, credit cards are what have gotten most people who have credit problems into trouble. If you are paying cash, that very rarely happens. If you don't have the cash for a transaction, you may be in financial trouble, but you won't be as likely to buy something else to get you further in trouble.

Lenders such as banks, savings and loan institutions, and FCUs are also quite good about not making loans which a person can't service. Credit card companies aren't as good, making up for occasional bankruptcy losses with high interest rates, charges / penalties.

I am not a fan of the current bankruptcy laws. If you are considering filing for bankruptcy, seek God's will and try to find another solution. It has lost much of the stigma it once had and this is unfortunate. It should truly be an absolute last resort.

Credit card companies are also getting nastier about trying to get some extra money even from people who pay the balance each month (in addition to the fee they get from the retailer when the purchase is made). If you have problems, shop around for a better card with better terms or call and negotiate. Remember that there is usually a grace period before they pay the merchant as well, so it is only costing them a nominal statement processing fee to extend you credit if you pay your balance monthly.

The credit card companies are playing a game with you. Their bet is that you will get hooked on the easy money train and start paying lots of interest eventually. Your bet should be that you will continue to pay off the balance each month forever. They whine about such people, but they are still very profitable.

When selecting credit cards, look at the total cost of using the card - grace periods, interest rates, penalties you might incur, and annual fees. Try to select a card with no annual fee, but read the fine print. You may have to make a certain number of purchases per year to avoid the annual fee. If the card has a low introductory rate, check what the rate will be when the introductory period is over. Don't count on getting another credit card application with a low rate to which you can roll your balance when the introductory period's rate ends.

If you can't find an acceptable credit card, use checks, cash, or debit cards with the Visa logo issued by a bank tied directly to your checking account. These don't have any credit line, but can otherwise be mostly used like a normal Visa credit card. The money comes directly out of your checking account when the card is used. Currently, the banks are trying to get people to stop using checks, so they aren't charging much for such debit card use. Expect that to change in the future as well.

Don't get huge numbers of credit cards. Your credit line on each card can cause problems getting normal loans for cars and houses since the banks don't know how far in debt you could go on your credit cards and assume the worst case. Having everything come in on one statement also aids in shock value if you are using credit cards unwisely. If you are carrying a balance, having everything on one card also gives you more negotiating room if the terms of the card aren't good.

Avoid using ATM machines which charge a fee for giving you your cash and avoid cash advances with credit cards. These usually have higher rates than that applied to credit balances and begin accruing charges immediately. Use the tellers at your bank to get cash.

On a side note, buying travelers checks effectively gives the issuer (American Express or Visa for example) an interest free loan for as long as you possess the check in addition to the fee they charge for giving you the travelers check in the first place.

Loans

With amortized loans, you pay most of the interest in the early part of the loan. For the car example listed above, $2,198.50 would be paid in interest by the time the loan was paid off if you didn't make advance payments. For the house loan listed above, $132,701.44 would be paid in interest with no advance payments. By paying an extra 9 years of principal payments with the last payment in the first year of the house loan above (an extra $8,590.66) you reduce the total interest payment by $54,574.22. That amount of money will be free on future paychecks for other purposes.

Try to get loans where you can make advance payments without incurring a penalty. Making the advance payments earlier - when it is frequently hardest to do - will save the most interest. In terms of house loans which are typically thirty year loans, you can frequently save more in interest than the purchase price of the house by making big early payments. The sooner you start, the more you save.

If you are disciplined you can also save considerable interest by taking out loans for shorter periods. The payments are higher per month and this is frequently a sufficient reason to select longer loan periods. If you can make early payments without penalty, then longer periods gives you the flexibility to pay off the loan like a shorter term loan when you have the money available, but only be committed to a smaller payment in general in case things get tough at some point.

ARM loans have gotten a bad wrap lately, but we have one and they work for us. The nice thing about them is that as you make advance payments, they recompute the next year's payment based on the outstanding balance at the time of interest reset for the remaining term of the loan. Thus, although our interest rate has gone up and down, the total monthly payment has generally been less since our advance payments reduced the amount being amortized on the schedule even when rates went up. I'd still recommend against making interest only loans or some of the other strange variants out there. Make sure your interest rate adjustment is limited and capped and that you can afford the payments at the highest capped rate.

Only loan money to friends and relatives under extreme duress. Assume you will never see it again. Be pleasantly surprised if you do. Remember that it is better to give than to lend and it costs about the same.

Service Contracts

Extended service contracts from appliance dealers aren't worth the money. They are, however, extremely profitable for the dealers which sell them, so there is a lot of pressure to buy one. Statistically, over enough customers, they make money. You might be unlucky and get a big repair bill for an item. But you probably won't.

Buy the best quality item you can afford. Check with Consumer Reports about best buys and repair histories. Then trust it won't break. Most electronics today are going to fail fairly soon (at least within the normal warranty) if they have a real quality problem. If they last several years before they fail you could probably buy a brand new replacement if it does fail for the price of the extended service agreements. Prices seem to keep drastically falling for many electronic goods and features keep rising. If something does break, just get it fixed and pay the costs then.

Insurance

The general rule for insurance is to only insure what you can't comfortably afford to replace yourself. There are some legal requirements which you must meet. For example, in Wyoming you must carry some insurance coverage on any automobile you license and provide proof of coverage. Lenders will also require insurance on the item purchased with a loan as long as they have an equity interest in the item.

You should provide insurance for your other tangible assets either in the form of your home policy or a separate renter's policy to cover losses due to standard perils. The cost for replacement value insurance isn't much more than standard insurance. This means the company pays closer to current replacement cost if a claim is filed rather than what you paid for it in the distant past.

You should carry medical insurance as the cost of health care is very high. Hopefully, the various health insurance reworks in Congress will make medical insurance more easy to obtain at some point in the future and less easy for the insurance companies to deny or argue about, but you should have some even if it is expensive. Use a group plan at your place of employment if possible. Otherwise shop around.

Finally, if there is someone who is dependent on your income and would need funds to survive if you die, you should have some form of life insurance. Until you get married, and perhaps even after that if both work, this insurance might not be necessary. It also might cease to be necessary at some point in the future when the kids are grown and the major bills are paid off.

There is occasionally some benefit for keeping all house, life, and auto insurance bundled in one company, but this isn't always the case. It doesn't hurt to shop around periodically. An insurance agent's business is to provide you with quotes. Check the reputation of the company as well to see how they handle claims. It is rare to find an insurance company - particularly in the health field - which receives glowing reviews for claims processing. Most are abominable.

You can also insure yourself by setting up an account which you contribute to for emergencies. But this might not be sufficient to cover all contingencies, especially in these litigious times. You need to get the advice of a financial adviser or insurance agent before deciding what to do. Generally simple term life insurance is cheaper than other insurance products sold. An umbrella policy is also a fairly good idea of cheap extra insurance for the perils of the day.

You should also make a will and keep it up to date.

Investing

Once you have your Budget working smoothly, have built up a sufficient reserve to get you through the tough spots caused by unemployment - car repairs - house repairs, ..., have the things insured which you cannot easily replace, and are starting to get some extra cash saved up that you can't figure out how to spend, the subject of investing comes up.

I am a firm believer in investment in the stock market. Many have strong negative feelings about it, but I feel that those around in the end times aren't going to have much of any place to stash money or other assets outside of the influences of Satan, so I don't feel that the stock market is particularly better or worse than anything else.

Over time, the stock market has outperformed every other financial investment there is. A $10,000 investment in an average bond fund in 1963 would have grown to $31,338 over fifteen years. The same amount invested in a balanced fund (stocks and bonds) would have produced $44,343. If invested in a growth and income fund (all stocks) you would have gotten back $53,157. If invested in an aggressive growth fund (all stocks, but more speculative), the investment would have grown to $76,556. If used to purchase hard assets, you might have significantly less than $10,000 after depreciation. The same spread of results would be seen over any sufficiently long time period you would like to examine. Accepting a greater risk for where you put your money yields greater return.

However, not everyone has the disposition to be able to handle riskier investments. You have to be able to handle days like Oct. 19, 1987. Days when 8 to 10% of your market valuation disappears in concerted Wall Street selling. (Some stocks fared better, and some worse.) You have to be able to handle one or more of your companies going bankrupt and wiping out your investment entirely. These things do happen - I assure you - they have happened to me.

You have to be able to handle extended bear markets where your investments may be down for several years without any bright spots in sight like the early thirties, the early seventies and perhaps the late nineties and late 00's. You need to be able to buy more of stocks you still feel are good stocks when they are being beaten up on Wall Street. When do you stock up on supplies at your favorite department store? When they're on sale. It should be no different int he stock market.

You need to be able to stomach volatility in your investment. With this increasing for most stocks in these last years, your investment might be worth a few hundred more one day and a few hundred less the next. If you need more stability than that, you probably should stick to Certificates of Deposit or savings accounts for the time being. Finally, you need to be able to watch a stock go on up after you have sold it or down after you have bought it without getting upset.

I won't offer any advice in this section about how to pick a particular individual stock. Peter Lynch managed the Fidelity Magellan Fund for years. He was one of the true greats when it came to fund management. $10,000 invested in the fund when he took over its management would have grown to $190,000 ten years later. He has written a book titled One Up on Wall Street in which he gives some very practical and good advice for how an individual investor can go about picking stocks and investing - and, just as importantly, whether or not you should be in the stock market at all. You can buy it in the bookstore or check it out of the library when you are ready to invest. The above numbers on returns come from that book.

Some practical tips:

- Be sure your basic needs are taken care of in transportation and housing. If you are still paying interest on your car or house, the next tip applies here as well.

- Pay off your short term debt first since it tends to have a higher interest rate. Some long term debt might qualify here as well. I have had some good stock picks and some poor ones, but my average rate of return is still less than the most common credit card interest rate (19.8%). This is especially true after factoring in taxes. Don't invest until you have eliminated the high interest rate expense items first.

The theoretical historical average rate of return in the stock market is 9.8% before taxes. You may do better or worse, depending on the stock picks you make. But if you are paying higher interest than the average ROR in the stock market pay it off first - at least until you know what you are doing in the stock market and can do better than the average reliably. The return on your money by paying off credit cards and loans early is guaranteed. The stock market return isn't. - You have to pay attention to your changing circumstances and how that influences your investment decisions. Using myself as an example, I became very cautious after I bought my house due to the new high debt levels to which I wasn't accustomed. You can't be afraid to buy or sell and make money in stocks. For myself, I had to reduce the debt for the house before I could really move forward in the stock market again, even though the interest rate was quite a bit less than my average rate of return in the market. That took several years and didn't leave me with much cash. It has taken time to build cash back up again, but my personality required me to take care of that before I could be effective in the stock market again. I got cautious again when I got married and had children. I felt I needed a larger cash buffer to take care of a family if something happened at work than I needed for just myself. What influences you may be something completely different, but whatever it is pay attention to it.

- Don't put money into stocks that you may need in the next five years. If losing the money you invest would be a problem in the foreseeable future, don't invest it.

- Use a discount broker. Full service brokers are like full service gas stations. You end up with the same product anyway. It just costs more. And today, there really isn't any difference in convenience between the major discount brokers and the full service ones. The savings are substantial.

- Make your own decisions. Don't just blindly buy the hot tip of the week from your best friend or broker. It may be a good deal, but be sure of it yourself before you invest. I also don't recommend mutual funds. They don't give enough better return (on average) than the general market index funds to justify their costs. (Magellan is currently closed to new investors).

- You can get just as rich buying a few shares in an expensive big name stock on the NYSE as several hundred shares of a smaller unknown stock trading for pennies on NASDAQ, and have a lot fewer gray hairs in the long run. (Note that NASDAQ does have some good large companies of its own and some NYSE stocks have had tremendous drops in prices in 2008 and 2009.)

- Don't try to buy at the very bottom or sell at the very top. It is great when you can, but much less nerve racking if you let the professionals fight over the bottom 15% and the top 15% of each price swing and just keep the 70% in between for yourself. Their trading costs are a lot less than yours are due to their volume. Most big name company prices fluctuate up and down by about the same percentage each year. Their high and low prices may be trending up over time or down over time, and that is what makes it hard to really spot each year's true high and low. The percentage change, however, is fairly consistent.

Buying near the bottom for a particular year and selling near the top for a particular year is better than holding on forever. If you still like the stock next year, buy it back again when it is again near the low. A few companies (such as Albertson's have basically trended up for a long period) due to expansion. Others such as Walmart followed that path for quite a while, but are now finding they have saturated the market and are becoming more cyclical.

Figure 9-1. IBM Stock Example

Enter initial discretionary funds balance: $10,000.00 Tax rate percent : 28% Charitable donations percent: 10% Personal spending percent : 0% Buy at low percent : 15% Sell at high percent : 15%

| Year | High | Low | % Change | Year | High | Low | % Change | Year | High | Low | % Change |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1997 | 113.500 | 63.562 | 78.6 | 1986 | 80.938 | 59.625 | 35.7 | 1976 | 36.062 | 27.938 | 29.1 |

| 1996 | 83.000 | 41.562 | 99.7 | 1985 | 79.375 | 58.688 | 35.3 | 1975 | 28.438 | 19.688 | 44.4 |

| 1995 | 57.312 | 35.125 | 63.2 | 1984 | 64.250 | 49.500 | 29.8 | 1974 | 31.750 | 18.812 | 68.8 |

| 1994 | 38.188 | 25.688 | 48.7 | 1983 | 67.125 | 46.125 | 45.5 | 1973 | 45.656 | 29.391 | 55.3 |

| 1993 | 29.938 | 20.312 | 47.4 | 1982 | 49.000 | 27.812 | 76.2 | 1972 | 42.641 | 33.172 | 28.5 |

| 1992 | 50.188 | 24.375 | 105.9 | 1981 | 35.750 | 24.188 | 47.8 | 1971 | 36.578 | 28.328 | 29.1 |

| 1991 | 69.875 | 41.750 | 67.4 | 1980 | 36.375 | 25.188 | 44.4 | 1970 | 38.703 | 21.875 | 76.9 |

| 1990 | 61.562 | 47.250 | 30.3 | 1979 | 40.250 | 30.562 | 31.7 | 1969 | 36.875 | 29.172 | 26.4 |

| 1989 | 65.438 | 46.688 | 40.2 | 1978 | 38.750 | 29.375 | 31.9 | 1968 | 37.500 | 28.000 | 33.9 |

| 1988 | 64.750 | 52.250 | 23.9 | 1977 | 35.750 | 30.562 | 17.0 | 1967 | 32.406 | 17.672 | 83.4 |

| 1987 | 87.938 | 51.000 | 72.4 |

| Year | Start Balance | Buy Shares | Buy Price | Commission | Sell Price | Commission | Profit | Tax | Tithe | Spent | Net | End Balance |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1967 | $10000.00 | 498 @ | 19.882 | 89.41 | 30.196 | 90.15 | 4956.84 | 1387.91 | 495.68 | 0.00 | 3073.24 | $13073.24 |

| 1968 | $13073.24 | 440 @ | 29.425 | 107.68 | 36.075 | 93.49 | 2724.83 | 762.95 | 272.48 | 0.00 | 1689.39 | $14762.63 |

| 1969 | $14762.63 | 482 @ | 30.327 | 117.71 | 35.720 | 98.87 | 2382.45 | 667.09 | 238.25 | 0.00 | 1477.12 | $16239.75 |

| 1970 | $16239.75 | 661 @ | 24.399 | 94.51 | 36.179 | 125.66 | 7566.22 | 2118.54 | 756.62 | 0.00 | 4691.05 | $20930.81 |

| 1971 | $20930.81 | 704 @ | 29.566 | 113.26 | 35.341 | 129.52 | 3822.82 | 1070.39 | 382.28 | 0.00 | 2370.15 | $23300.96 |

| 1972 | $23300.96 | 670 @ | 34.592 | 122.71 | 41.220 | 140.47 | 4177.67 | 1169.75 | 417.77 | 0.00 | 2590.15 | $25891.11 |

| 1973 | $25891.11 | 809 @ | 31.830 | 133.00 | 43.216 | 145.37 | 8932.83 | 2501.19 | 893.28 | 0.00 | 5538.36 | $31429.47 |

| 1974 | $31429.47 | 1508 @ | 20.753 | 133.28 | 29.809 | 178.34 | 13345.21 | 3736.66 | 1334.52 | 0.00 | 8274.03 | $39703.49 |

| 1975 | $39703.49 | 1883 @ | 21.000 | 160.49 | 27.125 | 198.55 | 11174.33 | 3128.81 | 1117.43 | 0.00 | 6928.09 | $46631.58 |

| 1976 | $46631.58 | 1593 @ | 29.156 | 183.27 | 34.844 | 213.17 | 8663.75 | 2425.85 | 866.37 | 0.00 | 5371.52 | $52003.10 |

| 1977 | $52003.10 | 1652 @ | 31.341 | 200.86 | 34.972 | 220.65 | 5577.32 | 1561.65 | 557.73 | 0.00 | 3457.94 | $55461.04 |

| 1978 | $55461.04 | 1794 @ | 30.781 | 212.23 | 37.344 | 251.08 | 11309.81 | 3166.75 | 1130.98 | 0.00 | 7012.08 | $62473.12 |

| 1979 | $62473.12 | 1943 @ | 32.016 | 235.28 | 38.797 | 278.76 | 12661.93 | 3545.34 | 1266.19 | 0.00 | 7850.39 | $70323.51 |

| 1980 | $70323.51 | 2607 @ | 26.866 | 261.13 | 34.697 | 328.50 | 19826.44 | 5551.40 | 1982.64 | 0.00 | 12292.39 | $82615.91 |

| 1981 | $82615.91 | 3175 @ | 25.922 | 301.60 | 34.016 | 386.40 | 25009.66 | 7002.71 | 2500.97 | 0.00 | 15505.99 | $98121.90 |

| 1982 | $98121.90 | 3154 @ | 30.991 | 352.56 | 45.822 | 506.92 | 45918.28 | 12857.12 | 4591.83 | 0.00 | 28469.34 | $126591.23 |

| 1983 | $126591.23 | 2560 @ | 49.275 | 446.28 | 63.975 | 570.46 | 36615.26 | 10252.27 | 3661.53 | 0.00 | 22701.46 | $149292.70 |

| 1984 | $149292.70 | 2876 @ | 51.712 | 520.79 | 62.038 | 618.79 | 28555.12 | 7995.43 | 2855.51 | 0.00 | 17704.18 | $166996.87 |

| 1985 | $166996.87 | 2693 @ | 61.791 | 579.13 | 76.272 | 603.60 | 37815.28 | 10588.28 | 3781.53 | 0.00 | 23445.47 | $190442.34 |

| 1986 | $190442.34 | 3021 @ | 62.822 | 656.29 | 77.741 | 669.20 | 43744.05 | 12248.34 | 4374.41 | 0.00 | 27121.31 | $217563.66 |

| 1987 | $217563.66 | 3834 @ | 56.541 | 745.36 | 82.397 | 831.80 | 97555.70 | 27315.60 | 9755.57 | 0.00 | 60484.53 | $278048.19 |

| 1988 | $278048.19 | 5119 @ | 54.125 | 944.32 | 62.875 | 1088.80 | 42758.13 | 11972.28 | 4275.81 | 0.00 | 26510.04 | $304558.23 |

| 1989 | $304558.23 | 6131 @ | 49.500 | 1031.50 | 62.625 | 1291.20 | 78146.68 | 21881.07 | 7814.67 | 0.00 | 48450.94 | $353009.17 |

| 1990 | $353009.17 | 7122 @ | 49.397 | 1190.95 | 59.416 | 1426.42 | 68736.16 | 19246.13 | 6873.62 | 0.00 | 42616.42 | $395625.59 |

| 1991 | $395625.59 | 8577 @ | 45.969 | 1331.10 | 65.656 | 1780.40 | 165748.18 | 46409.49 | 16574.82 | 0.00 | 102763.87 | $498389.47 |

| 1992 | $498389.47 | 17584 @ | 28.247 | 1669.09 | 46.316 | 2717.57 | 313334.25 | 87733.59 | 31333.42 | 0.00 | 194267.23 | $692656.70 |

| 1993 | $692656.70 | 31731 @ | 21.756 | 2308.15 | 28.494 | 3013.65 | 208465.82 | 58370.43 | 20846.58 | 0.00 | 129248.81 | $821905.51 |

| 1994 | $821905.51 | 29720 @ | 27.562 | 2733.22 | 36.312 | 3591.38 | 253725.40 | 71043.11 | 25372.54 | 0.00 | 157309.75 | $979215.25 |

| 1995 | $979215.25 | 25380 @ | 38.453 | 3250.60 | 53.984 | 4551.41 | 386381.11 | 108186.71 | 38638.11 | 0.00 | 239556.29 | $1218771.54 |

| 1996 | $1218771.54 | 25424 @ | 47.778 | 4038.55 | 76.784 | 5149.80 | 728266.55 | 203914.63 | 72826.66 | 0.00 | 451525.26 | $1670296.81 |

| 1997 | $1670296.81 | 23440 @ | 71.053 | 4753.00 | 106.009 | 4753.00 | 809868.50 | 226763.18 | 80986.85 | 0.00 | 502118.47 | $2172415.28 |

| Totals | 65060.68 | 976574.64 | 348776.66 | 0.00 |

Figure 9-1 contains a sample for one of the bluest of the blue stocks (IBM) and a sample scenario. It has a few assumptions which aren't completely valid, but I can't really fix them without more work than a quick demo is worth.

- It assumes there is no additional cost to buy in other than 100 share increments which hasn't always been true.

- Your tax rate percent remains constant. Actually, over these years Congress has played many games with taxes on stock sales and dividends, so this isn't actually true. Also, in many cases some of these investments would have pushed you into other tax brackets with other potential problems.

- The current year's dividend is assumed to have been paid at all times. In some cases a higher one was paid in earlier years. In some cases a lower was paid.

- A discount commission rate schedule is used in calculating the cost of the transactions. Discount brokers only arrived fairly recently on the investment scene and full service brokers would have reduced profits in earlier years. The schedule used isn't the most aggressive available. Internet trading of stocks is now really cheap. (2023 update: Some brokerages like Fidelity now offer commission free trades. There's still a fee paid when selling to the exchange, but it is minor.

- It assumes that each year you bought at the indicated % away from the low and sold at the indicated % away from the high. If you weren't that lucky some years, your return would be less. It also assumes that the stock was trending up or if down that you shorted the stock instead. This again is perhaps somewhat optimistic. But this is just for a fun demo anyway.

Figure 9-1. AUD Stock Example

Enter initial discretionary funds balance: $10,000 Tax rate percent : 28% Charitable donations percent: 10% Personal spending percent : 0% Buy at low percent : 15% Sell at high percent : 15%

| Year | High | Low | % Change | Year | High | Low | % Change | Year | High | Low | % Change |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1997 | 62.688 | 39.500 | 58.7 | 1987 | 13.625 | 8.062 | 69.0 | 1977 | 1.922 | 1.359 | 41.4 |

| 1996 | 45.750 | 35.625 | 28.4 | 1986 | 9.750 | 7.156 | 36.2 | 1976 | 2.234 | 1.562 | 43.0 |

| 1995 | 41.188 | 28.750 | 43.3 | 1985 | 7.500 | 4.406 | 70.2 | 1975 | 2.047 | 0.859 | 138.2 |

| 1994 | 29.875 | 23.812 | 25.5 | 1984 | 5.031 | 3.688 | 36.4 | 1974 | 1.781 | 0.649 | 174.7 |

| 1993 | 28.438 | 23.438 | 21.3 | 1983 | 5.562 | 4.109 | 35.4 | 1973 | 2.945 | 1.172 | 151.3 |

| 1992 | 27.812 | 19.375 | 43.5 | 1982 | 4.750 | 2.578 | 84.2 | 1972 | 3.117 | 2.250 | 38.5 |

| 1991 | 22.000 | 12.500 | 76.0 | 1981 | 3.969 | 2.922 | 35.8 | 1971 | 2.445 | 1.359 | 79.9 |

| 1990 | 15.062 | 11.312 | 33.1 | 1980 | 3.312 | 2.047 | 61.8 | 1970 | 1.547 | 0.734 | 110.6 |

| 1989 | 12.688 | 8.938 | 42.0 | 1979 | 2.562 | 1.797 | 42.6 | 1969 | 1.359 | 0.656 | 107.1 |

| 1988 | 11.812 | 8.656 | 36.5 | 1978 | 2.281 | 1.438 | 58.7 | 1968 | 0.789 | 0.438 | 80.4 |

| Year | Start Balance | Buy Shares | Buy Price | Commission | Sell Price | Commission | Profit | Tax | Tithe | Spent | Net | End Balance |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1968 | $10000.00 | 18859 @ | 0.490 | 754.36 | 0.736 | 754.36 | 3133.19 | 877.29 | 313.32 | 0.00 | 1942.58 | $11942.58 |

| 1969 | $11942.58 | 14896 @ | 0.762 | 595.84 | 1.254 | 595.84 | 6139.94 | 1719.18 | 613.99 | 0.00 | 3806.77 | $15749.34 |

| 1970 | $15749.34 | 17572 @ | 0.856 | 702.88 | 1.425 | 702.88 | 8588.32 | 2404.73 | 858.83 | 0.00 | 5324.76 | $21074.10 |

| 1971 | $21074.10 | 13489 @ | 1.522 | 539.56 | 2.282 | 539.56 | 9175.22 | 2569.06 | 917.52 | 0.00 | 5688.63 | $26762.73 |

| 1972 | $26762.73 | 11058 @ | 2.380 | 442.32 | 2.987 | 442.32 | 5828.40 | 1631.95 | 582.84 | 0.00 | 3613.60 | $30376.34 |

| 1973 | $30376.34 | 20553 @ | 1.438 | 822.12 | 2.679 | 822.12 | 23871.28 | 6683.96 | 2387.13 | 0.00 | 14800.19 | $45176.53 |

| 1974 | $45176.53 | 52627 @ | 0.818 | 2105.08 | 1.611 | 2105.08 | 37519.10 | 10505.35 | 3751.91 | 0.00 | 23261.84 | $68438.38 |

| 1975 | $68438.38 | 63515 @ | 1.038 | 2540.60 | 1.869 | 2540.60 | 47715.64 | 13360.38 | 4771.56 | 0.00 | 29583.70 | $98022.07 |

| 1976 | $98022.07 | 57548 @ | 1.663 | 2301.92 | 2.134 | 2301.92 | 22461.70 | 6289.28 | 2246.17 | 0.00 | 13926.26 | $111948.33 |

| 1977 | $111948.33 | 75449 @ | 1.444 | 3017.96 | 1.837 | 3017.96 | 23672.12 | 6628.19 | 2367.21 | 0.00 | 14676.72 | $126625.05 |

| 1978 | $126625.05 | 78940 @ | 1.564 | 3157.60 | 2.155 | 3157.60 | 40308.74 | 11286.45 | 4030.87 | 0.00 | 24991.42 | $151616.46 |

| 1979 | $151616.46 | 77683 @ | 1.912 | 3107.32 | 2.448 | 3107.32 | 35418.59 | 9917.21 | 3541.86 | 0.00 | 21959.53 | $173575.99 |

| 1980 | $173575.99 | 76239 @ | 2.237 | 3049.56 | 3.123 | 3049.56 | 61443.87 | 17204.28 | 6144.39 | 0.00 | 38095.20 | $211671.19 |

| 1981 | $211671.19 | 67867 @ | 3.079 | 2714.68 | 3.812 | 2714.68 | 44304.43 | 12405.24 | 4430.44 | 0.00 | 27468.74 | $239139.94 |

| 1982 | $239139.94 | 81232 @ | 2.904 | 3249.28 | 4.424 | 3249.28 | 116999.46 | 32759.85 | 11699.95 | 0.00 | 72539.67 | $311679.60 |

| 1983 | $311679.60 | 71365 @ | 4.327 | 2854.60 | 5.345 | 2854.60 | 66882.39 | 18727.07 | 6688.24 | 0.00 | 41467.08 | $353146.68 |

| 1984 | $353146.68 | 89880 @ | 3.889 | 3595.20 | 4.830 | 3595.20 | 77352.98 | 21658.83 | 7735.30 | 0.00 | 47958.84 | $401105.53 |

| 1985 | $401105.53 | 81686 @ | 4.870 | 3267.44 | 7.036 | 3267.44 | 170366.36 | 47702.58 | 17036.64 | 0.00 | 105627.15 | $506732.67 |

| 1986 | $506732.67 | 66804 @ | 7.545 | 2672.16 | 9.361 | 2672.16 | 115946.69 | 32465.07 | 11594.67 | 0.00 | 71886.95 | $578619.62 |

| 1987 | $578619.62 | 64745 @ | 8.897 | 2589.80 | 12.791 | 2762.83 | 246748.22 | 69089.50 | 24674.82 | 0.00 | 152983.90 | $731603.52 |

| 1988 | $731603.52 | 79785 @ | 9.130 | 3191.40 | 11.339 | 3191.40 | 169892.18 | 47569.81 | 16989.22 | 0.00 | 105333.15 | $836936.67 |

| 1989 | $836936.67 | 87729 @ | 9.500 | 3509.16 | 12.125 | 3540.26 | 223239.21 | 62506.98 | 22323.92 | 0.00 | 138408.31 | $975344.98 |

| 1990 | $975344.98 | 81858 @ | 11.875 | 3274.32 | 14.500 | 3946.91 | 207656.02 | 58143.69 | 20765.60 | 0.00 | 128746.74 | $1104091.72 |

| 1991 | $1104091.72 | 79025 @ | 13.925 | 3661.40 | 20.575 | 5395.60 | 516459.25 | 144608.59 | 51645.93 | 0.00 | 320204.74 | $1424296.45 |

| 1992 | $1424296.45 | 68776 @ | 20.641 | 4714.61 | 26.547 | 6055.10 | 395438.54 | 110722.79 | 39543.85 | 0.00 | 245171.89 | $1669468.35 |

| 1993 | $1669468.35 | 68793 @ | 24.188 | 5520.97 | 27.688 | 6315.53 | 228939.00 | 64102.92 | 22893.90 | 0.00 | 141942.18 | $1811410.53 |